Content

The total costs to complete the project are estimated to be $6 million of which $3 million has been incurred up to 31st December 2012. Contractors PLC received $2 million mobilization advance at the commencement of the project. We will show how the business should recognize the revenue while following the realization principle. Typically, this will happen when the business has rendered the services or transferred the goods to the customer. The realization principle states that revenues are only recognized when they are realized. In this case, under the realization principle, revenue is earned in May (i.e., when the transfer took place, notwithstanding the fact that the order was received in April and cash was received in June).

A second scenario is when the payment for corresponding goods is made after the goods have been delivered. Again, the accountant is not going to wait for receiving cash to recognize revenue. Instead, according to the recognition principle, a receivables account will be created and the revenue is going to be realized the moment it is earned i.e. at the time delivery of goods has been made. This is known as the transfer of ‘risk and rewards’ because the risk of damage or loss of goods is eliminated and delivery has been accomplished. Revenue recognition is a generally accepted accounting principle (GAAP) that identifies the specific conditions in which revenue is recognized and determines how to account for it.

What Is Revenue Recognition?

The realization principle of accounting is one of the pillars of modern accounting that provides a clear answer to this question. At the same time, the realization principle also gave birth to the accrual system of accounting. Simply omitting the figure from the financial statements is not accurate either. It doesn’t provide any insight into the future for planning purposes or lend towards https://www.vizaca.com/bookkeeping-for-startups-financial-planning-to-push-your-business/ securing loans or assessing business performance against targets. However, due to unforeseen circumstances, such a lack of activation caused by vendor delays, for example, the subscription only gets deployed in April, and not in January. This means that by the end of the year, the company has only realized $900 of the projected $1,200 – translating to a realization of 75% of revenue.

- For instance, in this example, $222 ($8,000/36) will be recorded for the services rendered each month.

- The order management process starts with technical validation and customer end validation, which is carried out to validate the technical details, site details and end customer details.

- A fundamental point to remember is that revenue is earned only when goods are transferred or when services are rendered.

- Consequently, the $1,000 is initially recorded as a liability (in the unearned revenue account), which is then shifted to revenue only after the product has shipped.

- Revenue realization and revenue recognition are two different events that impact your ability to accurately forecast and reflect on the true earnings in a period.

- Nevertheless, the seller also classifies the same revenues initially as Unearned Revenues, an entry in a Liability account.

So, the revenue needs to be recorded on 20th March because risk and rewards have been transferred on this date. For companies that use accrual accounting, revenues from sales of goods and services are said to be realizable revenues by the seller only when there is a good reason to believe the seller will receive payment. The realization principle gives an accurate view of a business’s profits by ensuring that income is not recognized until the risk and rewards have been transferred. However, in SaaS companies, realization is the ratio of how much of a Sales deal or commitment has been recognized as revenue. Essentially, revenue realization is defined as sales converted into revenue.

IASB and FASB issue new, converged revenue standards

The buyer is given the option of paying through a credit card or cash on delivery. One way or the other, the order will be delivered and the payment will be received. Now definitely you have to record this transaction in your journal and ledger to include in the financial statements. Revenue recognition states that revenue is recorded when it is realized, or realizable and earned, as opposed to received.

Revenue realization and revenue recognition are two different events that impact your ability to accurately forecast and reflect on the true earnings in a period. The seller does not realize the $1,000 of revenue until its work on the product is complete. Consequently, the $1,000 is initially recorded as a liability (in the unearned revenue account), which is then shifted to revenue only after the product has shipped. Price realization is a process by which you evaluate your sales performance between two periods for a consistent scope of products (namely, you focus exclusively on products that were sold on both periods of time). This approach is often used to measure the selling price variation from one period to another (following a price policy change, for instance).

Revenue Realization Principle

When the customer does pay, or when the buyer provides proof that payment is truly forthcoming, the seller realizes revenues. The product or service has been exchanged for cash, claims to cash, or an asset that is readily convertible to a known amount of cash or claims to cash. This principle allows the revenue actually earned during a year to be recognized instead of only what is collected.

- Accounting concepts are the basics on which the process of accounting works.

- Addressed the challenges faced in revenue realization for an international third-party logistics business.

- The revenue should be recognized at this point whether or not the payment has actually been received.

- Instead, according to the recognition principle, a receivables account will be created and the revenue is going to be realized the moment it is earned i.e. at the time delivery of goods has been made.

- Similarly, an expense should be recognized when goods are bought or services are received, whether cash is paid or not.

Solved Case 5-2 ZZZZ BestManagement assertions are implied

March 11, 2022

Content

Accounting management assertions are implicit or explicit claims made by financial statement preparers. These assertions attest that the preparers abided by the necessary regulations and accounting standards when preparing the financial statements. There are five different financial statement assertions attested to by a company’s statement preparer. These include assertions of accuracy and valuation, existence, completeness, rights and obligations, and presentation and disclosure. If the auditor finds that the claims are inappropriate, it has implications for the audit report of the entity. The extensive level of assurance gives more reasonable confidence to the auditor.

It is possible that this balance actually exist (existence) and entity has all necessary rights over it (Rights and Obligations) but it lacks completeness. The general audit objectives described in Exhibit 7-2 may be applied to any category of transaction and the related account balances. Auditors design specific tests to address these objectives in each audit area. For example, an auditor will develop tests to determine whether a company has properly accounted for its borrowing transactions during the period. These tests are specific to the accounts and information systems in place at the company being audited.

Understanding Financial Statement Assertions

Since financial statements cannot be held to a lie detector test to determine whether they are factual or not, other methods must be used to establish the truth of the financial statements. Inventory is another area that auditors may review to determine that inventory is properly valued and recorded using the appropriate valuation methods. Accuracy looks at specific transactions and then checks the accuracy of the recorded entry to determine whether the amounts are recorded correctly. In many cases, an auditor will look at individual customer accounts, including payments. To verify that the amount recorded as paid is the same as received from the customer.

Audit evidence consists of both information that supports and corroborates management’s assertions regarding the financial statements or internal control over financial reporting and information that contradicts such assertions. Responsibility for operations, compliance, and financial reporting lies with management of the company. A company’s various reports are assumed to represent a set of management assertions.

Chegg Products & Services

For example, accounts payable notes payable and interest payable are all considered payables, but they are all very separate entities and should be reported as such. For example, notes payable transactions should never be classified as an accounts payable transaction, with the same being true for interest payable transactions. Auditors may look at other assets as well to determine whether they are the property of the business or are just being used by the business. Liabilities are another area that auditors will review to determine that any bills paid from the business belong to the business and not the owner. Completeness helps auditors verify that all transactions for the period being examined have been properly entered in the correct period. Some of these include reviewing accounts and reconciliation of payables to supplier statements.

The entity holds or controls the rights to assets, and liabilities are the entity’s obligations. The presentation should be made as the applicable financial reporting framework. For these, the auditor needs to verify the backup documents which claim such investments have been made by the company.

Transaction-Level Assertions in Auditing

The four assertions included in this category are occurrence, rights & obligations, completeness, and valuation & allocation. Auditors may also directly contact the bank to request current bank balances. Financial statements are the documents that show financial health by calculating liquidity ratio, debt-equity ratio, return on equity ratio, bookkeeping for startups and so on. These statements help to attract investors to finance business activities. You can test the authenticity of the existence of the assertions by physically verifying all noncurrent assets and receivables. 3/ When using the work of a specialist engaged or employed by management, see AU sec. 336, Using the Work of a Specialist.

Assertions are claims that establish whether or not financial statements are true and fairly represented in the process of auditing. The rights and obligations assertion states that the company owns and has the ownership rights or usage rights to all recognized assets. For liabilities, it is an assertion that all liabilities listed on a financial statement belong to the company and not to a third party.

How Can Outsourced Accounting Services Benefit For Small Businesses?

January 13, 2022

Content

Small businesses that have this function overseen in-house find it one of the most cumbersome aspects of running a business. Discover the benefits of investing in custom mobile app development and how it can help boost your business success through increased customer engagement. We can work with your current accountant or bookkeeper if you are not already using our Outsourced Accounting Services. We really feel that there’s a roadmap for a future expansion with Escalon as well. Once materials are gathered and we have an action plan, then we begin implementation.

- Growth-focused accounting services can be more costly, starting at around $750 a month, but these services are designed for growing businesses with more complex financial needs.

- Therefore, the first thing you need to consider when you outsource bookkeeping for your small business is whether you need basic bookkeeping—compliance—or you’re ready to move on to full-service accounting.

- Focus on operational efficiency, good quality control, lesser back office costs.

- During the early stages, most small businesses primarily focus on compliance—receiving payments, paying bills, checking the accuracy of the payroll, and following federal and state regulations.

- You have access to experienced and highly trained bookkeepers when you outsource this function for your small business.

- Be sure to make your month-to-month relationship clear, and expectations set at the beginning so it minimizes the chance of this happening.

- Typically, the lower your expenses (and the fewer your accounting needs), the less you’ll be charged.

Bookkeeping services can help small businesses stay organized and maintain accurate financial records, which is crucial for making informed business decisions and preparing tax returns. Outsourced accounting firms offer a wide range of services beyond bookkeeping and reconciliation. Popular services include tax planning and budget planning, which small businesses can also benefit from. Proper planning leads to better investment decisions and higher returns, rather than simply fulfilling legal requirements or operating a business with limited resources. Rather than looking for a jack-of-all-trades, entrepreneurs should look for a firm that specializes in their industry. At Milestone, we specialize in working with professional services companies as well as scaling SaaS and tech startups and nonprofits.

What Accounting Services Does a Small Business Need?

But accrual accounting can give you a better understanding of where your business stands. So, choose a service that does the right accounting for your business’s size and complexity. Here are NerdWallet’s picks for the top online bookkeeping services for small businesses. With a small business accountant on your team, you can focus on running your business instead of struggling to keep track of its finances.

What is the average monthly cost for small business bookkeeping?

On average, outsourced bookkeeping services cost anywhere between $500 to $2,500 a month for small and medium businesses depending on the hours you need each month. Even at the top of the range – $2,500 per month – it would cost your business $30,000 a year.

Our partners cannot pay us to guarantee favorable reviews of their products or services. Digital transformation can help small businesses to unlock their full business potential. The balance sheet is a statement of your assets, liabilities and capital/equity at any given time. Get expert advice on every topic you need as a small business owner, from the ideation stage to your eventual exit. Our articles, quick tips, infographics and how-to guides can offer entrepreneurs the most up-to-date information they need to flourish. My return on equity is really giving me that solid tax advice so I do make the transactions promptly and I lessen my tax burden.

Better Business Scalability

Outsourced accounting firms take this task seriously, as it is their livelihood. As a result, they place a high priority on accurate and timely accounting. This allows small business owners to have clearer financial information to make informed decisions and plan for the future.

Let’s look into three different options your company could consider to fill this need… And remember, with outsourcing, your services can grow as your business grows. If you’re starting out and are in need of foundational accounting services, like bookkeeping and financial forecasting, it can be as affordable as $250 a month.

Some Reasons Why You Should Outsource Payroll Services

In other words, their performance quality must align with your objectives. We’ll never share your email address and you can opt out at any time, we promise. He is ethical and honest, which is very important to me when conducting business. Sunil is also a good communicator, which is yet another valuable business trait.

- We’ll generate meaningful metrics and reports that give you real insight into your profitability and costs.

- But before you start searching “how much should I pay an accountant for my small business,” let’s take a look at some facts.

- Want to kick off your small-business accounting with a solid accounting software service?

- Considering the price point and more advanced CFO-level features you can add to your plan, inDinero is best suited for medium-sized and quickly growing businesses.

- Since then, we’ve expanded to offering these to all small business owners throughout the country.

Along with offering the typical outsourced bookkeeping services, AccountingDepartment.com provides outsourced controller services. With this service, their CPAs manage bookkeeping while also budgeting, forecasting, doing job costing, managing cash flow, tracking inventory, and performing other financial management tasks on your behalf. Outsource business bookkeeping services to Outsource2india and benefit from professional accounting and bookkeeping services that can provide you with the insights you need to make better business decisions. We provide the highest data security and offer very quick turnaround times without compromising on quality and accuracy. Besides, our services are also highly cost-effective, and we can work with any bookkeeping software that you choose.

Accounting Done™

We have had the pleasure of serving small businesses across a variety of industries. From construction to the service industry, we provide a full-range of accounting services and work with you to understand the unique needs of your company and industry. By choosing not to outsource your bookkeeping, you basically give yourself room to get really hands-on with your business’s growth. This will help you to quickly spot and correct any inconsistencies in your balance sheet caused by human errors—which you may miss if all you have are reports put together by your bookkeeper. For business owners, handing over the control of the books can sometimes feel uncomfortable.

Most services touch base monthly, but in some cases, you can pay extra to receive weekly reports. Depending on the company, you can speak with your bookkeeper (or team of bookkeepers) as often as you’d like or at least a few times per month. ScaleFactor, a company that offered automated bookkeeping tools and outsourced accounting services to small businesses, closed down in 2020 due to its steep pricing. Their packages cost about $6,000 to $30,000 a year, and they couldn’t convince small business owners that their service was worth it (particularly during COVID-19).

Digital Accounting Assessment & Implementation

They can provide peace of mind knowing that your finances are being managed accurately and efficiently. They can also offer valuable insights into ways to save money and outsourced bookkeeping services improve your financial flow. Hiring a qualified professional means keeping tabs on expenses and income, maintaining organized records, and staying on top of taxes.

- If a small business owner attempts to manage everything, they may lose sight of their true vision for growing their business, focusing only on earning money.

- Outsourcing most of your financial accounting can free your time and resources and allow you to concentrate on your company’s primary capabilities rather than the back office.

- If you want a higher level of support in the future, such as chief financial officer or CFO-style services, consider choosing a bookkeeping service that will allow you to upgrade later.

- There are major differences between the three types of bookkeepers and what each can offer your business.

- For example, you may have paid for A/R (Accounts Receivable), and now you need to handle payroll and A/P (Accounts Payable) as well.

- Using outsourced bookkeeping services for small businesses can shoulder some of your back-office burdens, take charge of your company finances limit errors, and remove internal fraud at maximum.

Our Outsourced Accounting Services team leverages cloud-based applications like Sage Intacct and QuickBooks Online to facilitate financial records on your terms. Digital access that’s https://www.bookstime.com/ available from any device helps you make data-driven decisions that are based on up-to-date information. External audits can be stressful and time-consuming for small businesses.

Accounting vs Law: Whats the Difference?

May 24, 2021

Content

- Incorrectly differentiating income and revenue

- Why it’s important to organize your law firm’s accounting and bookkeeping

- Interest on lawyers’ trust accounts (IOLTA)

- Law Firm Accounting: The Ultimate Guide

- Benefits of using MyCase for your Law Firm Accounting Needs

- What special considerations do accountants for law firms need to pay attention to?

To ensure you don’t intermingle, keep separate accounts for your business and your personal finances. For bookkeeping purposes, ensure you’re only tracking transactions that occur within your law firm’s accounts. If for any reason you make a mistake (such as depositing a personal check in your business account), make sure to track it in your books. Lawyers are not accountants and they often make the same common mistakes when it comes to accounting for law firms.

- Before proceeding further, let’s clarify the difference between bookkeeping and accounting.

- Once you have a strategy and budget in place, the work of day-to-day management sets in.

- You’re required to do this every 30 to 60 days depending on your state — be sure to check your state’s rules.

- Unfortunately, bookkeeping mistakes have consequences for your business, income taxes, and license.

- This is especially important when it comes to paying mandatory disability or worker’s compensation insurance.

There are many different software options available to help with efficient legal bookkeeping. A good law firm accounting software should include features such as billing and invoicing, bookkeeping, reporting and analytics, and payroll. The software should also include a mileage tracker, the ability to offer online payments, timekeeping tools, and the ability for multiple users to access the tools.

Incorrectly differentiating income and revenue

Intermingling expenses isn’t a fatal mistake but it causes problems for your business when it comes to claiming expenses and tracking the financial health of your business. Now that you understand that bookkeeping happens first, I suggest you figure out the best way to handle bookkeeping before we move on to legal accounting. Bookkeepers track your finances so you can view at a glance how much money is entering and leaving your business. And because they’re tax compliant, you can feel confident they’ll keep your books organized and prepared for tax filing.

- But on-site service requires extra office space and computer for our bookkeeper.

- Accrual accounting records revenues and expenses when they are earned and incurred, regardless of when the money is actually received or paid.

- You can also schedule invoices to automatically generate and go out to clients on specific dates or at set intervals.

- For example, if the trust account statement balance does not match the trust ledger balance, it could mean that client funds have been misappropriated.

- The following guide explains the fundamentals of law firm accounting and bookkeeping.

- Law firms who use Soluno are able to make better business decisions to accelerate their earnings.

- Not only is accounting complex, but it’s also time-consuming, and you have other responsibilities.

- These are two different types of transactions and need to be managed accordingly.

See what strategic opportunities you have for reinvestment and plug those into your budget. If you’re trending behind, it is better to know sooner rather than later so you can react accordingly. It will be much easier to pick a few numbers and keep those top of mind. Many small firms find that outsourcing their bookkeeping functions is a great first step in delegating work off the owner’s plate. With those distinctions in mind, it becomes easier to see which type of professional help you might need.

Why it’s important to organize your law firm’s accounting and bookkeeping

Your business’s accounting method will affect cash flow, tax filing, and even how you do your bookkeeping. You’ll need to choose an accounting method before your firm files its first tax return, and then stick with it on all subsequent returns. As an attorney, you’re aware that when you receive money that belongs to a client, you must place those funds https://www.bookstime.com/ in a trust account separate from your own money. These funds are stored in IOLTA or “interest on lawyers trust accounts” accounts. Speaking of expenses, one of the most common mistakes attorneys make is losing track of business expenses. It’s best to capture and record your business expenses on the daily, so you don’t lose those receipts or invoices.

Why hire a bookkeeper instead of an accountant?

Bookkeepers and accountants share the same long-term goal of helping your business financially thrive, but their roles are distinct. Bookkeepers focus more on daily responsibilities, like recording transactions, while accountants provide overarching financial advice and tax guidance.

While a bookkeeper keeps the day-to-day data accurate and updated, a Controller can help you set up and oversee your financial system and accounting infrastructure. Controllers often oversee the bookkeeper’s work, reconcile the accounts, and make more significant ledger adjustments. Follow these rules and keep track of client funds every day to ensure you don’t cross any lines that can cause your firm serious problems.

Interest on lawyers’ trust accounts (IOLTA)

It’s about keeping you ahead of the curve with smarter tech and specialists who truly understand your firm and its business. We provide a comprehensive range of services and unparalleled industry and technical knowledge to assist law firms and their partners. Working with our law firm clients to add value law firm bookkeeping services to the firm and its partners through the delivery of our global tax, assurance and advisory services. Trustbooks has completely changed my view on trust accounting for my firm. It takes into account all of the trust accounting requirements of the State Bar and helps make sure you comply with them.

These best practices all come back to one idea — staying organized. You want to pay attention to the ABA’s rules, as not doing so could lead to some severe consequences. With that said, there are some basic regulations that you’ll want to abide by regardless of where you’re practicing.

Law Firm Accounting: The Ultimate Guide

To avoid these issues, lawyers and bookkeepers need to use accounting software such as Clio Payments. This type of software can automate processes and improve cash flow. The use of accounting software is important for bookkeeping in a law firm because it enables the efficient tracking of clients, invoices, and other financial data related to running the firm.

Cost-benefit analysis Formula, Examples, & Steps

March 17, 2021

Since it’s based on adding positive factors and subtracting negative ones to get a net result, it is also known as running the numbers. In turn, this latter indicator is obtained by the sum of further three indicators. In the international literature the evaluation by means of CBA of the production of RAC and their use in structural applications such as in buildings has been just developing. CBA can be effectively used within a more robust risk management phase to support decision-makers.

- Here are some suggested steps to follow to ensure you can get the most out of CBA in your project decision making.

- This can help you identify and understand your costs and benefits, and will be critical in interpreting the results of your analysis.

- The most important contributor to an accurate, insightful cost-benefit analysis is accurate data.

- During those two years, a total of $300,000 in cash flow is generated by this project.

ProjectManager has one-click reporting that lets you can create eight different project reports. Cost-benefit analysis is a technique that helps decision-makers choose the best investment opportunities in different scenarios. Here are some of the most common applications for a cost-benefit analysis in project management. Critics of cost-benefit analysis argue that reducing all benefits to monetary terms is impossible and that a quantitative economic standard is inappropriate to political decision making.

Deliver your projectson time and under budget

Project managers often perform and evaluate a CBA, so they are 100% certain their project will be successful. If the estimated benefits outweigh the cost, this is an indication that this could be a good decision to make. If, however, the costs outweigh the benefits, then leadership may want to rethink the project or decision. A CBA involves measurable financial metrics such as revenue earned or costs saved as a result of the decision to pursue a project. It is recommended to perform a CBA during the initial stages and planning process of a project.

This is the case in relation to most energy activities, where the consequences of actions may not be known until far into the future, particularly in the case of environmental impacts such as global warming. This provides the basis for a technique accountant for startups known as discounting, which allows future costs and benefits to be compared with those in the present. To make your calculations as accurate as possible, try comparing costs and benefits from similar projects you’ve completed in the past.

Environment Impact Assessment

When conducting a CBA, be thorough with all estimates in order to arrive at the most accurate analysis to support necessary decisions. Other benefits to the business include higher revenue, improved customer satisfaction and employee morale, competitive market advantage, and reducing the complexity of business decisions. Creating a cost-benefit analysis can seem like a project in its own right, especially if you’re working with multiple stakeholders to get the job done. Before you dive in, consider using a project management tool to coordinate work. Asana lets you create and assign tasks, organize work, and communicate with stakeholders directly where work happens.

Cost-Benefit Analysis and the Problem of Long-term Harms from … – Yale Journal on Regulation

Cost-Benefit Analysis and the Problem of Long-term Harms from ….

Posted: Fri, 26 May 2023 12:35:19 GMT [source]

This helps you estimate the full economic benefit (or lack thereof) of your choice so you can decide if it’s a good idea to pursue. Similarly, decide what metric you’ll be using to measure and compare the benefits and costs. For projects that involve small- to mid-level capital expenditures and are short to intermediate in terms of time to completion, an in-depth cost-benefit analysis may be sufficient enough to make a well-informed, rational decision. For very large projects with a long-term time horizon, a cost-benefit analysis might fail to account for important financial concerns such as inflation, interest rates, varying cash flows, and the present value of money. Analysts should also be aware of the challenges in determining both explicit and implicit benefits. Explicit benefits require future assumptions about market conditions, sales quantities, customer demands, and product expectations.

List and categorize costs and benefits

CBA in whatever form is a necessary process all organisations should consider in order to assist decision making and ensure investment funds are spent on projects which promise the greatest return. It will also assist with better ownership and governance over benefits realisation once the project starts which is critical. You calculate the selling price of the 100 additional units per hour multiplied by the number of production hours per month. Add another two percent for the units that aren’t rejected because of the higher quality of the machine output. The real trick to doing a cost-benefit analysis well is making sure you include all the costs and benefits and properly quantify them. The analysis can be used to help decide almost any course of action, but its most common use is to decide whether to proceed with a major expenditure.

- An analyst or project manager should apply a monetary measurement to all of the items on the cost-benefit list, taking special care not to underestimate costs or overestimate benefits.

- If you don’t want to include more complex calculations like net present value, benefit-cost ratio, discount rates, and sensitivity analysis, you don’t have to.

- One issue is that it is often difficult to indicate to what extent values like safety, health, sustainability, and aesthetics contribute to the value of human happiness, and to furthermore express this in monetary terms.

- Cost-benefit analysis is used to determine whether an investment represents an efficient use of resources.

- A company must be mindful of limited resources that might result in mutually-exclusive decisions.

With Bentham’s classical variant of utilitarianism, for example, the assumption is that all relevant moral values can eventually be expressed in terms of the moral value of human happiness. One issue is that it is often difficult to indicate to what extent values like safety, health, sustainability, and aesthetics contribute to the value of human happiness, and to furthermore express this in monetary terms. A second, more fundamental issue, is that such an approach treats all these values as extrinsic values, whose worth should ultimately be measured on the basis of their contribution to the intrinsic value of human welfare. One might wonder whether values like human health, sustainability and aesthetics do indeed have only extrinsic value or are worthwhile in themselves. This potential objection to cost-benefit analysis amounts to an objection to the method being based on value monism.

Select Appropriate Accounting Method

Your cost-benefit analysis clearly shows the purchase of the stamping machine is justified. The machine will save your company more than $15,000 per month, almost $190,000 a year. You subtract your total cost figure from your total benefit value and your analysis shows a healthy profit. You calculate the monthly cost of the machine by dividing the purchase price by 12 months per year and divide that by the 10 years the machine should last.

And of course, sometimes the right answer will be “do nothing.” At least with a solid cost-benefit analysis, companies can make hard decisions with their eyes wide open. Our fictional SaaS provider has a traditional direct sales model, where its asset maintenance scheduling software is sold as service directly to end customers. Customers may also purchase direct from the website, which does not generate a commission. The decision-maker is recommended to use this approach with caution because the available information is subject to varying levels of quality, detail, variability, and uncertainty. Nevertheless, the tool is far from unusable and can provide meaningful information for aiding decision-making, especially if it takes the levels of variability and uncertainty into account and thus avoids misleading results. CBA is a way of encouraging people to think about, describe, and then measure the multiple impacts of different policies and projects in a consistent manner.

Deferred Revenue: What Is it, How to Record, & More

December 25, 2020

All you need to do is set up item(s) mapped to a deferred revenue liability account and send it to your customer. Then, when the customer pays the invoice it debits your bank account and credits A/R. At this point, you still have the credit balance in deferred revenue that you need to move to income. After the marketing event, create a journal entry and debit deferred revenue and credit the appropriate income account and you’re good to go. The journal entry for deferred revenue has to be a credit entry because it is recognized as a liability. Understanding the basics of accounting is vital to any business’s success.

Deferred Revenue: Revenue Recognition in Microsoft Dynamics … – MSDynamicsWorld

Deferred Revenue: Revenue Recognition in Microsoft Dynamics ….

Posted: Thu, 21 Nov 2019 08:00:00 GMT [source]

There are also many non-cash items in accrual accounting for which the value cannot be precisely determined by the cash earned or paid, and estimates need to be made. The entries for these estimates are also adjusting entries, i.e., impairment of non-current assets, depreciation expense and allowance for doubtful accounts. However, in practice, revenues might be earned in one period, and the corresponding costs are expensed in another period.

Deferred revenue journal entry with examples

If you’re using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee. And, you will not be able to properly calculate your SaaS gross margin and recurring gross margin. And without gross margins, it’s hard to steer the financial performance of your business or assess the impact of new bookings or new headcount.

- Since the services are to be delivered equally over a year, the company must take the revenue in monthly amounts of $100.

- We’ll take a closer look at deferred revenue and what you need to know for your bookkeeping and accounting.

- This is because it has an obligation to the customer in the form of the products or services owed.

- These 12-month subscriptions cost $500 per month, billed as a one-time $6,000 fee.

The bookkeeping service will start from October 2020 to March 2021. However, most SaaS companies I have spoken with are incorrectly recording their most important revenue stream. That is SaaS subscription revenue and the corresponding deferred revenue balance. In contrast to accruals, deferrals are cash prepayments that are made prior to the actual consumption or sale of goods and services. An accrued expense is an expense that has been incurred (goods or services have been consumed) before the cash payment has been made.

Deferred Revenue Journal Entry

Deferred revenue is common with subscription-based products or services that require prepayments. Examples of unearned revenue are rent payments received in advance, prepayment received for newspaper subscriptions, annual prepayment received for the use of software, and prepaid insurance. For deferred revenue, the cash received is usually reported with an unearned revenue account. Unearned revenue is a liability created to record the goods or services owed to customers.

From the perspective of the landowner, the rent cannot be recognized as revenue until the company has received the benefit, i.e. the month spent in the rented building. An example of a deferral would be a company paying for rent in advance. In order to abide by the matching principle, a deferral must be made to adjust for quickbooks online 2021 the prepaid rent expense. To visualize this, let’s take a look at a $5,000 upfront payment that qualifies as deferred revenue. Notice how as the asset column (cash) increases, so too does the liability column (deferred revenue). In simplest terms, deferred revenue is revenue earned before rendering goods or services.

What is the Revenue Recognition Principle?

As the product or service is delivered over time, it is recognized proportionally as revenue on the income statement. When expenses are prepaid, a debit asset account is created together with the cash payment. The adjusting entry is made when the goods or services are actually consumed, which recognizes the expense and the consumption of the asset. In accrual accounting, revenues and the corresponding costs should be reported in the same accounting period according to the matching principle.

This usually happens when a company sells a product or service but does not deliver it until a later date. Deferred revenue only applies to businesses that use accrual basis accounting. Hence, deferred revenue is treated as a liability and is converted from liability to actual revenue when the distribution or delivery of what the customer paid for has been done. Hence, the initial deferred revenue journal entry that was made when the prepayment was received will be adjusted to record when the company or individual delivers the goods or service to the customer. Deferred revenue is always considered a liability since it is a reflection of the goods and services that you currently owe your customers.

Payroll Services Lincoln, NE

December 9, 2020

Content

Tax return services, small business accounting services, small business payroll services, and QuickBooks® services are available. Small business accounting services include bookkeeping/data entry, accounting services, financial statements, and financial analysis. Easily develop and maintain your company’s financial records and plan for success with advice and guidance from Michael Jank. In addition to managing https://www.bookstime.com/ your receivables and payables, his small business accounting services assist with payroll, involving the creation of monthly financial reports. Plus, his professional bookkeeping services also benefit individuals looking to set financial goals, build budgets, and manage cash flow throughout the year. Whatever your financial needs may be, ensure they are in good hands when you trust Michael Jank.

© 2023 Website design for accountants designed by Build Your Firm, providers of accounting marketing services. We provide business incorporation services and will direct you to the entity with the most tax advantages. We can also show you how write a business plan to obtain financing. Our team at the A.C.T. Group, L.L.C., aims to provide local businesses with immediate assistance, so they receive the best technical expertise needed to navigate the modern business climate. Although we only work with our clients part-time to meet their financial needs, we measure our success by their success. We take great pride in seeing our long-term clients grow their business year after year.

Welcome to the BBB!

We offer insights into how to position your finances to help them grow. This ensures that you are positioned to handle growth without falling into financial pitfalls that can plague small businesses. At PMC Tax Service LLC, we are here to help provide various services and tax help to our clients in Lincoln.

Our core focus is helping small businesses and non-profits focus on their mission and leave the accounting to us. Whether it’s bookkeeping, payroll, financial statements or tax documentation, we offer a tailored approach for each of our partners. The reality is that time spent handling bookkeeping is time you are not spending building and growing your business. We are able to easily handle all aspects of accounting including bookkeeping, accounts payable, accounts receivable, payroll, taxes, and compliance with any state or federal regulations. I ensure that your bookkeeping is done accurately and in a timely manner. This reduces or eliminates overdrafts, late fees, and unnecessary interest charges when payments are late or missed.

So how do I help small businesses increase profits by an average of $7500 per year?

The firm owner and founder, Perry L. Demma, obtained his certified public accountant certificate and permit to practice from the State of Nebraska in 1973. HBE is a full-service company that offers an array of accounting solutions in Lincoln and nearby areas. It caters to clients in the healthcare, manufacturing, construction, and agribusiness industries. The enterprise provides bookkeeping services, which include QuickBooks, Zoho, and XERO setup. Its accountants help business owners record and compile their purchases, expenses, and sales revenue.

- Our Lincoln Square C.P.A. firm specializes in QuickBooks, allowing us to manage your transactions and books efficiently.

- Although we only work with our clients part-time to meet their financial needs, we measure our success by their success.

- Contact us today to get set up with accountants in Lincoln Square you trust.

- Let us help you with all of your tax preparation needs today.

- From tax return preparation and bookkeeping services to strategic and financial business consultations, he’s here to help you plan your financial future.

- The reality is that time spent handling bookkeeping is time you are not spending building and growing your business.

This firm offers tax management services, accounting services, payroll services, bookkeeping/write-up, compilation and review services, and bill paying services. Is a proud member of the American Institute of CPAs and the Nebraska Society of CPAs. Its owner, Clinton Hlavaty, offers bookkeeping, accounting, and consulting services, helping clients grow their businesses.

Accounting Services

We supply a variety of accounting and bookkeeping services for small businesses, including financial statements, budgeting, and cash flow maintenance. Don’t risk improperly filing your sales tax, incorrectly distributing 1099s, or failing to work alongside a notary during company legal matters. Calling on our over 20 years of experience, we’ve evolved alongside https://www.bookstime.com/bookkeeping-services/lincoln the software and technologies that have come about in recent decades. As we have grown with these best practices, we have honed our craft and streamlined our process to provide you with some of the top-quality accounting services in the industry. We can also provide the services necessary to run a C-corporation, S-corporation, and LLC set up.

It helps businesses owners who encounter increasing profitability, decreasing taxes, tax notices/surprises, or simply want more time. Comprehensive Accounting Services offers accounting, payroll service, tax service, bookkeeping, and business counseling. In addition, the firm provides a complimentary consultation.

Accounting Services in Lincoln, NE

Contact us today to get set up with accountants in Lincoln Square you trust. Or perhaps you are looking to start up your own business but don’t know what the first step would be. In some cases, BBB will not rate the business (indicated by an NR, or “No Rating”) for reasons that include insufficient information about a business or ongoing review/update of the business’s file. Whether it’s a Tax Return or a Bookkeeping Appointment, you are in the right hands. Please click on the button below to schedule your appointment online.

It also offers website design, logo creation, and content management services. As a cloud-based firm, it can assist clients regardless of their location. Comprehensive Accounting Services is an accounting firm that is located in Lincoln, Nebraska and serves small businesses owners in the greater Lincoln, Nebraska area.

No matter how complicated your situation may be, we’ll make the process simple for you. When you work with TAC Payroll Solutions, you can feel confident that your business finances are in great hands. We know firsthand that the entrepreneurial grind never takes a day off.

- HBE is a full-service company that offers an array of accounting solutions in Lincoln and nearby areas.

- These solutions cover accounts payable and receivable, payroll, taxes, invoicing, and reconciliations.

- We understand that each one of our clients will have unique circumstances, backgrounds, objectives, and needs.

- Accurate financial reports help your accountant minimize your tax liability and can reduce their cost since they won’t have to spend their time getting the books in order.

- Services include income tax and strategies, financial planning, bookkeeping solutions, payroll, and attestation services.

- © 2023 Website design for accountants designed by Build Your Firm, providers of accounting marketing services.

We will analyze your workflow to help identify any problems that preventing productive work at your company. Our team will set up an accounting system, as well as provide training for yourself and your staff to prepare your whole team for success. Every company strives for growing value for its shareholders. While this is consistently one of the ultimate goals for businesses, this process can easily go south if not planned and executed properly. PMC Tax Service is familiar with the complexities of tax law and how to work within it so that you benefit rather than the tax collectors. See how these clients fared before you trust us to assist you.

The Best Small Business Accountants in Lincoln Square

At Perkins Schaffer CPAs, Inc., we offer optimal financial solutions to meet the accounting and bookkeeping needs of all kinds of small businesses. We’ll keep your finances organized and up to date while you focus your efforts on core business issues. And we’ll deliver regular, meaningful, financial reports to make sure you always have a clear financial snapshot of your business. The ACT Group provides accurate information and sound guidance on the best ways to structure your organization while keeping aligned with your mission. Start building a solid financial future today when you choose Michael Jank at Comprehensive Accounting Services to handle your business finances and bookkeeping services.

- Reach out to TAC Payroll Solutions to get started with our payroll services in Lincoln, NE today.

- In my restaurant, I spent too much time trying to keep up with my daily, weekly and monthly bookwork and not nearly enough time using the information that came out of the bookkeeping.

- Additional services include bookkeeping, business consulting, buying and selling a business, retirement planning, financial planning, estate planning, business succession planning, and more.

- I’ve been a part-time bookkeeper for more than ten years for a small family farm and construction company.

- Burr Business Service is a comprehensive tax preparation firm that is located in Lincoln, Nebraska.

- Is a proud member of the American Institute of CPAs and the Nebraska Society of CPAs.

From identifying the best version of QuickBooks for your business to mapping accounts, creating reports, and cleaning up your data file, we provide comprehensive QuickBooks support. We understand that each one of our clients will have unique circumstances, backgrounds, objectives, and needs. Our team takes the time to listen and understand the situation before applying our expertise appropriately. Utilizing the strategy of working closely with you allows us to ask the right questions and fully focus on your company’s needs.

Retained Earnings What Is It, Examples, vs Net Income

December 2, 2020

Content

These accounts will not be set back to zero at the beginning of the next period; they will keep their balances. The next day, January 1, 2019, you get ready for work, but before you go to the office, you decide to review your financials for 2019. What are your total expenses for rent, electricity, cable retained earnings and internet, gas, and food for the current year? You have also not incurred any expenses yet for rent, electricity, cable, internet, gas or food. This means that the current balance of these accounts is zero, because they were closed on December 31, 2018, to complete the annual accounting period.

- Distribution of dividends to shareholders can be in the form of cash or stock.

- Therefore, making a comparative analysis with other periods would require the accountant or investor to take out the last 5 to 10 years of summaries.

- To me, the easiest way to understand debits and credits on the income statement is to consider first how each transaction is impacting the balance sheet.

- On the asset side of a balance sheet, you will find retained earnings.

- The income summary account balance is then transferred to the retained earnings account in the case of a corporation or the capital account in the case of a sole proprietorship.

- Decreases in stockholders’ equity accounts are debits; increases are credits.

As a result of higher net income, more money is allocated to retained earnings after any money spent on debt reduction, business investment, or dividends. Do not reduce retained earnings because you pay stockholder dividends. Instead, post these amounts as a debit to “dividends.” This amount is then deducted from your retained earnings balance as a separate line item on your balance sheet and statement of retained earnings. Net income increases Retained Earnings, while net losses and dividends decrease Retained Earnings in any given year. Thus, the balance in Retained Earnings represents the corporation’s accumulated net income not distributed to stockholders. Use this mnemonic to help you as you’re getting started, and pretty soon debits and credits will come to you naturally.

What is retained earnings? How to calculate them

It stores all of the closing information for revenues and expenses, resulting in a “summary” of income or loss for the period. The balance in the Income Summary account equals the net income or loss for the period. This balance is then transferred to the Retained Earnings account. Revenue accounts will appear on the credit side of the income summary account. This is because a revenue account in normal cases will have a credit balance.

Should retained earnings be a debit or credit?

The normal balance in the retained earnings account is a credit. This balance signifies that a business has generated an aggregate profit over its life.

The statements and opinions are the expression of the author, not LegalZoom, and have not been evaluated by LegalZoom for accuracy, completeness, or changes in the law. Form your business with LegalZoom to access LegalZoom Tax services. However, if the company also wanted to keep year-to-date information from month to month, a separate set of records could be kept as the company progresses through the remaining months in the year. For our purposes, assume that we are closing the books at the end of each month unless otherwise noted. We strive to empower readers with the most factual and reliable climate finance information possible to help them make informed decisions.

Normal balance of retained earnings definition

You must debit your revenue accounts to decrease it, which means you must also credit your income summary account. This is because it forms a part of the shareholders’ equity section of the balance sheet. However, if the value of these profits is negative, they are considered a debit balance. Retained earnings, as the name suggests, are the sum that a company retains after meeting all its financial liabilities, including the payment of the shareholders. This retained income is the amount companies use for reinvestment, which means utilizing the money back into the business.

Operating expenses, which are the costs incurred from normal business operations such as rent, equipment, inventory costs, marketing, payroll, insurance, and funds allocated for research and development. Retained earnings are calculated by taking the beginning balance of RE and adding net income and then subtracting out anydividendspaid. In a perfect world, you’d always have more money flowing into your business than flowing out. That’s when knowing how to make a cash flow statement comes in handy. Retained earnings are the profits that remain in your business after all costs have been paid and all distributions have been paid out to shareholders.

Colorado Small Business Bookkeeping Services O’Dell & Company

November 30, 2020

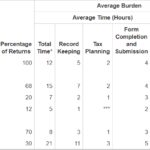

Accountants’ rates vary based on their education, licenses, experience, and the work for which they are being hired. An accountant may charge an hourly rate when a company or individual needs their services on a short-term basis, such as when performing an audit or requesting assistance setting up a financial database or process. Hourly rates can range as widely as $40 per hour to $300 or more per hour, depending on your geographic location and the accountant. Accountants may offer a package rate for weekly, monthly or annual services to reward ongoing customers.

Nationally, the average hourly rate nationally for a tax prep professional ranges between $150 and $450. Contact local CPAs or tax professionals to see if they can offer their services without in-person contact. Many firms can operate remotely or virtually, and others that typically operate face-to-face may be changing their procedures to keep up with social distancing guidelines.

How much do accountants charge for tax help?

The IRS has a searchable database where you can verify the background and credentials of your income tax preparation professional. Once you have selected someone, ask about their service fees and confirm their availability. Then provide them with all the documentation they require, including W-2s, 1099s and more. Always ask to review the paperwork before it is submitted, and never sign a blank tax return. Accountants do not automatically have a Certified Public Accountant (CPA) designation unless they have passed the Uniform CPA Examination and received the proper license. CPAs are also eligible to represent clients before the IRS if audit support is required, while a non-CPA accountant is not.

For more information, give us a call today and learn how we can get you organized and on track with current and relevant information from your bookkeeping process. YOU are your business, and your time is best spent https://accounting-services.net/bookkeeping-connecticut/ pursuing your passions and running your business, not tied to a desk working on your books. With access to 1M+ customer reviews and the pros’ work history, you’ll have all the info you need to make a hire.

WELCOME TO CHOICE CITY BOOKKEEPING

Our Fort Collins CPA team can help you with your small startup or your thriving corporation, whether you are local or across the country. Sourcing your bookkeeping needs to us will also save you the overhead of managing someone in-house to maintain your books Bookkeeping Fort Collins and keep them accurate. By sourcing your bookkeeping to us, you not only save money but also remove the time you normally spend having to manage an extra person from day-to-day. You can also ask an accountant to provide proof of their license and credentials.

How much should I pay a bookkeeper UK?

Well bookkeeping fees can be as little as £30 a month, or as much as £800+ a month.

This Tax Season Find Your Strength in Numbers With FreshBooks

November 11, 2020

Content

You can click the Settings icon to indicate whether you want to accept online payments, make the invoice recurring, or customize the style. For filing your taxes as a business, your best option is a platform that can integrate with your apps. Many of the accounting options above can work with tax software. Check with your app to find the ones it integrates with. FreshBooks’ suite of invoicing features is one of the product’s strong suits. You can choose from various customizable designs, set up recurring digital invoices, easily include discounts, and get instant updates when invoices have been viewed or paid online.

The client can then securely pay their bill with a couple of clicks. The FreshBooks app will notify you as soon as the invoice is paid. However, limits on the number of billable clients and internal users who can access the software pose a problem for businesses with multiple employees. Organizations with more complicated business models and multiple product lines should https://quick-bookkeeping.net/ choose an alternative that scales better with their growth and inventory needs. Project tracking tools in higher-tier plans; lacks industry-specific reports and transaction tracking tags; users with multiple businesses must pay for separate subscriptions. Whether you enter an expense manually or edit one you’ve imported, you can add or modify a lot of detail.

How does FreshBooks work?

Never question whether you business is “in the black”. Double-entry accounting is just another way that we are helping business owners like you manage their accounting professionally and effectively. You can nowcustomizeyour FreshBooks experience with a range of business-friendly apps. Take control of your Can Freshbooks Do Taxes? business accounting with the help of these integrations. Plus, accountant access makes it easy for bookkeepers to collaborate with their clients within FreshBooks. The all-new Accounting Software from FreshBooks helps you can control of your accounting and have everything you need come tax time.

Enter the client’s name and contact information, or as much as you have at hand. For every client you create, FreshBooks builds a client homepage, which eventually populates with additional information once you have a transaction history. Clicking the Invoices tab in the toolbar opens a page telling you everything you need to know about your accounts receivable (though the site doesn’t use that accounting term) status. This Invoices page provides a lot of information about your recent and historical invoices. With the From Me tab highlighted, you see dollar totals for invoices that are overdue, outstanding, and in the draft stage. Below are links to your most recently updated invoices.

Create or Update Client

A list of all invoices and recurring templates appears at the bottom. The above-described accounting software, Bonsai Tax, can be added on to either plan for $10 per month. For an additional $9 per month, Bonsai users can invite other users for full account access and company management. If you want to give regular clients the option to split invoices using partial payments or collect a deposit before a project kicks off, Bonsai can do that too. Hurdlr seamlessly tracks all of your FreshBooks payments, expenses, and tax deductions in real-time, on the go — saving you valuable time and maximizing your profit. Accept debit and credit cards with safe, secure, and convenient Payment Solutions from Chase anywhere you do business – online, in-store, and on-the-go.